Stocks Bloom In May

Consider a goals-based investment perspective going into summer The old adage “April showers bring May

Intuitive technology that supports your advisors

Marrying investment strategies to financial planning

Investment management consulting service

Customizable actively managed single-stock portfolio

Goals-based investing with Horizon Funds

Our latest thoughts, in and on the media

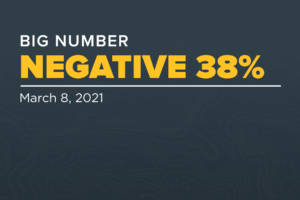

Our regular look at the market’s most revealing number

Our in-depth thinking on goals-based investing

What we do—and why we do it

What we do—and why we do it

Our culture and open positions

Topics

What one key metric reveals about market and economic conditions.

Consider a goals-based investment perspective going into summer The old adage “April showers bring May

The timely importance of taking a differentiated approach to diversification Bonds these days are doing

Some assets may have rallied too far, too fast Investors have breathed multiple sighs of

Despite lower levies for now, uncertainty remains On Monday, the U.S. and China announced that

A lengthy run for the S&P 500 These days, the stock market is showing up

Equity investors should look beyond the usual suspects these days This week marks the 100th

Market participants have fled dollar-based assets, leading to dollar weakness The U.S. dollar has experienced

Although uncertainty remains, perpetual market swings may be less frequent While still higher than what

The power of diversification has been on display throughout 2025 Headline after headline this week

History suggests a rebound could be in order The market’s smaller stocks are down—and it

Recent stock market losses are not as bad as they may seem Last week saw

Consumers may be tapping the brakes on their spending The outlook for the U.S. economy

The U.S. has been lagging Europe and China in recent months. It seems “America First”

Uncertainty is spiking, but optimism remains strong. The White House’s sweeping, and sometimes see-sawing, economic

Earnings have been much better than expected thus far among the market’s small companies. Large-company

New import taxes on China, while Mexico and Canada get a reprieve for now. The

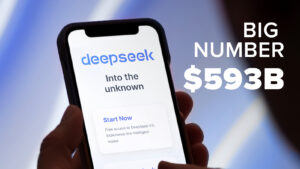

What does Nvidia’s historic rout mean for investors? The bad news: AI darling Nvidia lost

Will Trump’s tariffs push the greenback even higher? The U.S. dollar has risen sharply in

Will the U.S. economy’s growth machine keep on humming? Surging bond yields are rattling investors,

Do top-heavy markets eventually spread out? Many investors have experienced extraordinary stock market gains over

Small-cap stocks may offer tactical opportunities. Investors who expect a late-year, post-election rally in small-company

The digital currency seems to have the wind at its back these days. An ongoing

Opportunities outside of the top performers. It’s no secret that a small number of stocks

Positive earnings surprises are back on track. With more than 90% of the companies in

Stocks have had a habit of gaining ground no matter who becomes President. Regardless of

Buyers need lower rates to get back in the game. In anticipation of the Fed’s

Consumer spending, corporate earnings, and the overall economy remain robust. Investors will examine one of

The stock market is two years (and counting) into a bull market. Last Saturday marked

Lowest spreads in nearly three years Want more evidence that the U.S. economy is in

It’s been 17 years since we’ve seen a weekly return this strong Long-suffering Chinese stocks

Which sector has been leading the rally so far in 2024? One market sector has

Are you ready? All eyes are on Jerome Powell on Wednesday as investors await the

Successful investing doesn’t have to be a thrill ride. Anyone who has driven California’s Pacific

Here’s how stocks may perform for the rest of 2024 As the fall harvest season

Fed Chair Powell tees up the long-awaited rate cut Fed Chair Powell said just about

Best week of 2024 for the S&P 500 After a brief summer slump and a

U.S. company profits continue to impress. Earnings season is in the home stretch, with more

Market volatility spikes—but how much should you worry about it? The first full week of

A growing number of stocks are having their moment in the sun Everybody loves a

Don’t read too much into harbingers of stock market doom and gloom Sometimes, it pays—literally—to

Will softness in housing inflation, jobs, and other metrics prompt the Fed to act soon?

Six more months! Six more months! Investors cheered as stocks ended the second quarter last

Is the seventh month of the year a stock investor’s best friend? While scorching temperatures

Are there potential opportunities beyond the handful of big stock market winners? The equity market

Falling bond market volatility could support equity prices. Investors looking for signs of what stocks

Potential homebuyers are hitting the brakes. What could that mean for the future? Would-be homebuyers

Thanks to AI, it seems a bunch of people want Nvidia’s semiconductors. Is it Nvidia’s

Should investors consider opportunities in global stocks? We believe international stocks could deserve a place

Are U.S. consumers ready to go more rounds? “When will the consumer finally crack?” is

Generating goals-based income with an equity-centric, globally diversified portfolio. Memo to retirees seeking sustainable spending

It’s a big week for news from corporate America. Earnings season is in full bloom,

Middle East conflicts shouldn’t derail the strong domestic growth story. Rising Middle East tensions caused

Can economic growth tailwinds outweigh higher interest rates? Month-over-month retail sales for March topped economist

Can company profits exceed rising expectations? First quarter 2024 earnings season kicks off this week,

First-quarter returns suggest the market may have more to give. Stocks went out like a

Derivatives can be effective when you know what you’re buying or selling. Covered call option

Keeping a close eye on Treasury market volatility Volatility in the Treasury bond market is

Taking a tactical approach to “junk” bonds Yield-hungry investors eyeing an eventual Fed rate cut

Prices of many services are heating up again. Last week, we learned that the Fed’s

Do shares of non-U.S. companies deserve a place in your portfolio? With soaring U.S. stocks—and

Is stocks’ extended winning streak “an offer you can’t refuse”? The S&P 500 has now

Robust consumer spending continues to support a strong economy. Last week’s impressive jobs data—employers added

The economy and inflation are lining up as investors hoped they would. All eyes were

It could be a great time to buy stocks. Here’s why. Investors celebrated last Friday

“Sticky” shelter costs could keep overall prices uncomfortably high. While inflation’s steady march downward of

Value and growth index fund investors may be surprised by their returns last year. Investors

How are the “Magnificent 7” stocks really doing? Outperformance isn’t always exactly what it seems

Some crucial context on Americans’ “out of control” debt levels. “Credit Card Debt Crisis” “Credit

Most stocks have been laggards this year, but that could be starting to change. It’s

Will December bring glad tidings to small-company stocks? Small-cap stocks have had quite the slog

One active approach to risk management is currently beating the market. Risk management can be

The end of Fed rate hikes suggests good things for equities. The stock market’s surge

Three years of less-than-stellar financial market performance. It’s been a tough slog for investors over

GDP growth over the past three months may have been huuuuuge. Third-quarter GDP growth could

House hunters are facing a shocking number these days. Pity today’s homebuyers who are looking

It’s been bleak days—and lots of them—for bond investors. As the fourth quarter begins, bonds

The greenback’s recent rally could have legs. The U.S. dollar is lighting up the charts,

Falling interest rate volatility in Treasuries could herald a stock market rally. There are few

Sharply higher oil prices have the potential to re-ignite inflation. Last week saw oil prices

Historically, the 9th month of the year hasn’t been kind to investors. “April is the

There are few signs of the economic struggles predicted at Jackson Hole last year. Attention

Stock investors may want to brace for some bumps in the road. After months of

Other market sectors are showing signs of life. The S&P 500 continued its winning streak

Is the Fed’s battle to contain inflation finally done? The market seems to think so.

The S&P 500’s lowest correlation level in years suggests outperformers and underperformers should emerge. Think

Will six months of returns cause you to forsake global diversification? While it’s true that

Stock market volatility has fallen to multi-year lows? “Merrily, we roll along, roll along.” Those

The housing market is the latest economic indicator to light up the charts? One of

Does This Market Have Staying Power? Stocks escaped the bear’s grip. What comes next Investors

The positive surprises in the labor market just keep on coming. Job creation in the

Is the fast-moving market moving too fast? Technology stocks generally hate higher interest rates. Tech

Active management aims to navigate trends as they emerge—and fade We believe an active, dynamic

Apple is once again worth more than the entire Russell 2000 In Marvel movies, it’s

Fear-inducing headlines are likely painting too grim of a picture. Silicon Valley Bank. Signature. First

Investors seem to be a relatively calm, cool, and collected bunch these days—which may be

Identifying investment opportunities may take a sharper focus going forward Fears about banks’ financial health

What tools can investors use to fight longevity risk in retirement? Many retirees today probably

There’s tech, and there’s the rest Investors in tech stocks these days are a wildly

Here’s something we have only seen once in 20 years In a true study of

Stocks stand to benefit if the Fed eases up on the brakes Continued concerns about

Bank woes raise questions about the Fed’s next move. Investors’ sudden hunger for U.S. government

Chip stocks have come out swinging to start 2023 In what could be a harbinger

The U.S. real estate market has been flexing its muscles in recent weeks. Unexpected strength

U.S. stocks have clearly perked up so far this year. But now, two key market

In the wake of a bruising 2022, investors seem to have decided that “risk on”

Expected interest rate volatility has fallen 28 points so far this year The financial markets

Investors eye foreign markets and like what they see. For more than a decade, international

Put “protection” has come up short lately—but there’s a better way. Put options are often

Up is down, and down is up Two key components of the equity market—growth stocks

This year we have seen a first for stocks and bonds. Welcome to uncharted territory.

Everybody can appreciate a smooth ride—and for investors, a journey without too many bumps along

Throughout 2022, investors have seen various positive economic developments as signs that the Federal Reserve

Could bond investors find the next few months to be “the most wonderful time of

Investors won’t have to dip into their savings to pay for their Thanksgiving feasts this year,

Investors are shifting gears in the wake of good inflation news. Will it last? The

The losers of the past are riding high—while yesterday’s winners appear to be out of

We’re more than halfway through the third-quarter earnings season, and thus far, the S&P 500

The squeeze on homebuyers appears to be getting tighter by the month—which could spell trouble

We all know that last week’s inflation report showed headline inflation continues to surge, with

It’s a game of “catch me if you can” between investors and the Fed these

Tomorrow, the Federal Reserve Board is set to announce its latest decision regarding interest rates.

All eyes were once again on interest rates last week, as the European Central Bank

Demand for new homes is way down. What does that mean for investors? New home

It’s a safe assumption that when Bob Dylan sang “the first one now will later

What a difference a couple of months can make. Since hitting its low point (closing

Is More Volatility Coming Down the Pike? Investors looking for greater clarity about the road

As investors digested both the Fed’s decision to raise interest rates by another 75 basis

The U.S dollar continues its steady march higher, up 14.7% during the past 12 months.

Over the next few weeks, a steady stream of second-quarter earnings reports will reveal how

The S&P 500 hasn’t seen two consecutive quarters of negative returns since the global financial

Economists surveyed by the Wall St. Journal now say there’s a 44% chance of a

Red-hot inflation, and the Fed’s now-aggressive efforts to fight it, are pushing up mortgage rates

American workers are reliving the past – and that’s a potentially big problem. The reason:

Equity markets sent investors smiling into the Memorial Day weekend, thanks to the biggest weekly

With the Nasdaq plummeting 27.2% and the S&P 500 Growth Index close behind at -26.2%,

Investors in balanced portfolios these days may feel like they’ve fallen off a tightrope. The

Investors liked what they heard from the Fed this week. The Federal Reserve Board raised

No doubt about it: Fixed-income investors are spooked. Volatility in U.S. Treasuries has soared this

As Americans become more comfortable with Covid-19’s transition from pandemic to endemic, two of our

Now that the Federal Reserve Board has started raising rates, the upcoming first quarter earnings

Investors sure are a gloomy bunch these days. How downbeat are they? According to the

As expected, the Federal Reserve Board on Wednesday raised the target range of the federal

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Eye-popping jumps in energy prices worldwide has some people proclaiming we’re in a replay

From the youngest to the oldest American workers – GenZ to Baby Boomers – their

A large swath of the GenX population, many of whom are 20 years or less

The march higher in the cost of home health, assisted living or nursing home services

American workers just got another jolt of bad news about the financial health of Social

Federal Reserve Chairman Jay Powell repeated his view at last week’s Jackson Hole meeting that

There’s a record-breaking chasm opening up between American and Chinese stocks this year. The SPDR

The Baby Boomer retirement wave, egged on by Covid, rolls on. Another 248,000 Americans over

The Baby Boomer retirement wave, egged on by Covid, rolls on. Another 248,000 Americans over

You’ve likely heard that second quarter profits are surging, driven by easy year-over-year comparisons and

Target date funds operate under the assumption that someone’s asset allocation should follow a glide

Yet another setback for retirees who view traditional fixed-income investments as a secure way to

The Federal Reserve’s meeting last week sparked a selloff in stocks and bonds as the

Capturing the pandemic’s weird real-world effects is reflected in how high above trend retail sales

Bidding wars for homes has soured people on reaching for the American dream: for the

What was a rumbling of change in the last few years is now barreling into

What was a rumbling of change in the last few years is now barreling into

Millions of workers are retiring early. But not necessarily because they want to. The pandemic

When financial markets went haywire in March 2020, people pursuing a traditional financial plan may

Of all the financial challenges facing retirees, being a widow can be one of the

Nearly every day the financial news headlines trumpet the selloff in bonds and the rising

Like the famous Energizer Bunny, small-capitalization stocks keep on going versus their larger peers. Year

Does 2021 strike you as a replay of 1999? The investment theme now, as it

Up, up and away for the price of a new single-family home, which reached a

Inflation isn’t a problem now, but financial markets are saying it could be soon. Traders

A common investor assumption is that bonds tend to go up in value when the

When stocks fall, bonds rally. That’s standard market action today. And it makes bonds look

Categories

Topics

Consider a goals-based investment perspective going into summer The old adage “April showers bring May flowers” proved true on Wall Street this year. After falling

The timely importance of taking a differentiated approach to diversification Bonds these days are doing little to shore up investors’ bottom lines. In our opinion,

Some assets may have rallied too far, too fast Investors have breathed multiple sighs of relief in recent weeks as the Trump administration has dialed

Despite lower levies for now, uncertainty remains On Monday, the U.S. and China announced that they will temporarily suspend the high import tariffs they imposed

A lengthy run for the S&P 500 These days, the stock market is showing up on both the “best of” and “worst of” lists. For

Equity investors should look beyond the usual suspects these days This week marks the 100th day of President Trump’s current term in the White House.

Market participants have fled dollar-based assets, leading to dollar weakness The U.S. dollar has experienced a sharp decline this year through April 17, falling 9.8%

Although uncertainty remains, perpetual market swings may be less frequent While still higher than what Wall Street would prefer, market volatility has trended lower this

The power of diversification has been on display throughout 2025 Headline after headline this week highlighted that stocks posted their worst quarterly return since 2022—with

History suggests a rebound could be in order The market’s smaller stocks are down—and it may be time to pick some up. While the S&P

Recent stock market losses are not as bad as they may seem Last week saw the S&P 500 have its worst week since September. The

Consumers may be tapping the brakes on their spending The outlook for the U.S. economy took a hit recently—and investors will be watching carefully to

The U.S. has been lagging Europe and China in recent months. It seems “America First” doesn’t apply to the financial markets these days, as several

Uncertainty is spiking, but optimism remains strong. The White House’s sweeping, and sometimes see-sawing, economic policy announcements on tariffs and other issues have a growing

Earnings have been much better than expected thus far among the market’s small companies. Large-company stocks have outpaced their small-cap peers since the start of

New import taxes on China, while Mexico and Canada get a reprieve for now. The trade war has started—albeit with a smaller opening shot than

What does Nvidia’s historic rout mean for investors? The bad news: AI darling Nvidia lost $593 billion in market capitalization on Monday—the single-greatest one-day plunge

Will Trump’s tariffs push the greenback even higher? The U.S. dollar has risen sharply in value versus other world currencies in the past few months,

Will the U.S. economy’s growth machine keep on humming? Surging bond yields are rattling investors, fueling concerns that stocks may face turbulence ahead, driven by

Do top-heavy markets eventually spread out? Many investors have experienced extraordinary stock market gains over the past two years, with the S&P 500 up 26.3%

Small-cap stocks may offer tactical opportunities. Investors who expect a late-year, post-election rally in small-company stocks may need to be patient. Historically, December has been

The digital currency seems to have the wind at its back these days. An ongoing post-election surge drove Bitcoin’s price above $100,000 for the first

Opportunities outside of the top performers. It’s no secret that a small number of stocks in the S&P 500 have been largely responsible for the

Positive earnings surprises are back on track. With more than 90% of the companies in the S&P 500 index reporting their earnings results, we now

Stocks have had a habit of gaining ground no matter who becomes President. Regardless of which candidate emerges victorious, historically, investors have generally come out

Buyers need lower rates to get back in the game. In anticipation of the Fed’s rate cut last month, more would-be homebuyers applied for mortgages.

Consumer spending, corporate earnings, and the overall economy remain robust. Investors will examine one of the last snapshots of the economy’s health before election day—and

The stock market is two years (and counting) into a bull market. Last Saturday marked the second anniversary of the current bull market for stocks.

Lowest spreads in nearly three years Want more evidence that the U.S. economy is in good shape? Just take a look at the junk bond

It’s been 17 years since we’ve seen a weekly return this strong Long-suffering Chinese stocks broke out of their doldrums last week following the announcement

Which sector has been leading the rally so far in 2024? One market sector has outperformed all others so far this year—and it’s probably not

Are you ready? All eyes are on Jerome Powell on Wednesday as investors await the Federal Reserve Board’s near-certain decision to cut the federal funds

Successful investing doesn’t have to be a thrill ride. Anyone who has driven California’s Pacific Coast Highway or North Carolina and Tennessee’s Tail of the

Here’s how stocks may perform for the rest of 2024 As the fall harvest season begins, it’s a time of reaping the rewards of hard

Fed Chair Powell tees up the long-awaited rate cut Fed Chair Powell said just about everything investors wanted to hear during his Jackson Hole, Wyoming

Best week of 2024 for the S&P 500 After a brief summer slump and a short-lived overreaction, stocks enjoyed their best week since November, up

U.S. company profits continue to impress. Earnings season is in the home stretch, with more than 90% of the companies in the S&P 500 index

Market volatility spikes—but how much should you worry about it? The first full week of August started with a bang: The S&P 500 dropped 3%

A growing number of stocks are having their moment in the sun Everybody loves a good comeback story: Seabiscuit. The Mighty Ducks. 493 stocks in

Don’t read too much into harbingers of stock market doom and gloom Sometimes, it pays—literally—to look beyond what’s “obvious” to everyone else. Case in point:

Will softness in housing inflation, jobs, and other metrics prompt the Fed to act soon? Those long-sought-after Fed rate cuts are looking more plausible, thanks

Six more months! Six more months! Investors cheered as stocks ended the second quarter last Friday up 4.3%. . . and 15.3% for the first

Is the seventh month of the year a stock investor’s best friend? While scorching temperatures continue to sweep across much of the country, equity investors

Are there potential opportunities beyond the handful of big stock market winners? The equity market has spent the better part of 2024 notching a series

Falling bond market volatility could support equity prices. Investors looking for signs of what stocks may do next often turn to the bond market for

Potential homebuyers are hitting the brakes. What could that mean for the future? Would-be homebuyers are increasingly deciding to stay put —which could help further

Thanks to AI, it seems a bunch of people want Nvidia’s semiconductors. Is it Nvidia’s world and we’re just living in it? At least, that’s

Should investors consider opportunities in global stocks? We believe international stocks could deserve a place in many investors’ portfolios because they can potentially add diversification

Are U.S. consumers ready to go more rounds? “When will the consumer finally crack?” is a question that seems to be on more investors’ minds

Generating goals-based income with an equity-centric, globally diversified portfolio. Memo to retirees seeking sustainable spending power: Consider sticking with stocks. One of our core beliefs

It’s a big week for news from corporate America. Earnings season is in full bloom, with roughly half of the companies in the S&P 500

Middle East conflicts shouldn’t derail the strong domestic growth story. Rising Middle East tensions caused oil prices to briefly spike last week before reversing course

Can economic growth tailwinds outweigh higher interest rates? Month-over-month retail sales for March topped economist expectations at 0.7%, with February figures revised higher to 0.9%

Can company profits exceed rising expectations? First quarter 2024 earnings season kicks off this week, on the heels of reports showing both a robust jobs

First-quarter returns suggest the market may have more to give. Stocks went out like a lion in March, with the S&P 500 hitting its 22nd

Derivatives can be effective when you know what you’re buying or selling. Covered call option strategies can be an innovative and potentially impactful way to

Keeping a close eye on Treasury market volatility Volatility in the Treasury bond market is once again flirting with its recent lows. That could be

Taking a tactical approach to “junk” bonds Yield-hungry investors eyeing an eventual Fed rate cut are moving into high-yield corporate bonds thesedays, a show of

Prices of many services are heating up again. Last week, we learned that the Fed’s preferred inflation gauge—the core personal consumption expenditures(PCE) price index—rose by

Do shares of non-U.S. companies deserve a place in your portfolio? With soaring U.S. stocks—and domestic tech stocks in particular—capturing the headlines these days, it’s

Is stocks’ extended winning streak “an offer you can’t refuse”? The S&P 500 has now closed higher for 14 out of the last 15 weeks.

Robust consumer spending continues to support a strong economy. Last week’s impressive jobs data—employers added 353,000 new jobs in January, nearly double the expected amount—had

The economy and inflation are lining up as investors hoped they would. All eyes were on the Fed this week as it held its first

It could be a great time to buy stocks. Here’s why. Investors celebrated last Friday as the S&P 500 notched its first record-high close in

“Sticky” shelter costs could keep overall prices uncomfortably high. While inflation’s steady march downward of late has investors (and the Fed) cheering, it may be

Value and growth index fund investors may be surprised by their returns last year. Investors commonly own both value and growth stocks to diversify their

How are the “Magnificent 7” stocks really doing? Outperformance isn’t always exactly what it seems to be. Many investors this year have been hungrily eyeing

Some crucial context on Americans’ “out of control” debt levels. “Credit Card Debt Crisis” “Credit Card Debt Hits New Record” “Americans Are Drowning in Credit-Card

Most stocks have been laggards this year, but that could be starting to change. It’s no secret that a minute group of tech stocks has

Will December bring glad tidings to small-company stocks? Small-cap stocks have had quite the slog this year. Punished by rising interest rates and lingering fears

One active approach to risk management is currently beating the market. Risk management can be an important component of goals-based planning. Used well, it has

The end of Fed rate hikes suggests good things for equities. The stock market’s surge last week—U.S. and global equities soared nearly 6%—may be the

Three years of less-than-stellar financial market performance. It’s been a tough slog for investors over roughly the past three years, with most corners of the

GDP growth over the past three months may have been huuuuuge. Third-quarter GDP growth could be a monster. True, it’ll be a few weeks before

House hunters are facing a shocking number these days. Pity today’s homebuyers who are looking at an average monthly mortgage payment just shy of $2,900.

It’s been bleak days—and lots of them—for bond investors. As the fourth quarter begins, bonds are on track for a third consecutive calendar year of

The greenback’s recent rally could have legs. The U.S. dollar is lighting up the charts, rallying for the past ten weeks (see the chart). That’s

Falling interest rate volatility in Treasuries could herald a stock market rally. There are few things that make investors happier than having clarity about where

Sharply higher oil prices have the potential to re-ignite inflation. Last week saw oil prices hitting their highest point in 10 months following news that

Historically, the 9th month of the year hasn’t been kind to investors. “April is the cruelest month,” wrote poet T.S. Eliot—who, we assume, didn’t own

There are few signs of the economic struggles predicted at Jackson Hole last year. Attention will be focused on Wyoming this week, where the 46th

Stock investors may want to brace for some bumps in the road. After months of gains and low volatility from stocks, emerging signs show that

Other market sectors are showing signs of life. The S&P 500 continued its winning streak in July and is up more than 20% in 2023.

Is the Fed’s battle to contain inflation finally done? The market seems to think so. Recent comments from multiple Wall Street firms and economists suggest

The S&P 500’s lowest correlation level in years suggests outperformers and underperformers should emerge. Think the S&P 500’s low volatility these days means all is

Will six months of returns cause you to forsake global diversification? While it’s true that “the market” is up for the year, it’s really a

Stock market volatility has fallen to multi-year lows? “Merrily, we roll along, roll along.” Those Stephen Sondheim lyrics pretty much summarize the sentiment among a

The housing market is the latest economic indicator to light up the charts? One of the key leading indicators of future economic activity—construction of new

Does This Market Have Staying Power? Stocks escaped the bear’s grip. What comes next Investors cheered last week as the S&P 500 broke free of

The positive surprises in the labor market just keep on coming. Job creation in the U.S. continues to defy expectations. Case in point: last week’s

Is the fast-moving market moving too fast? Technology stocks generally hate higher interest rates. Tech companies often need ongoing access to lots of capital to

Active management aims to navigate trends as they emerge—and fade We believe an active, dynamic approach to portfolio management can provide investors the potential to

Apple is once again worth more than the entire Russell 2000 In Marvel movies, it’s common for one superhero to be bigger than an entire

Fear-inducing headlines are likely painting too grim of a picture. Silicon Valley Bank. Signature. First Republic. PacWest. Comerica. The list of regional banks that have

Investors seem to be a relatively calm, cool, and collected bunch these days—which may be a harbinger of stock market strength in the coming months.

Identifying investment opportunities may take a sharper focus going forward Fears about banks’ financial health have dominated many investors’ thoughts for weeks. But as we

What tools can investors use to fight longevity risk in retirement? Many retirees today probably remember the 1976 disco hit “Right Back Where We Started

There’s tech, and there’s the rest Investors in tech stocks these days are a wildly happy bunch. Everybody else? Not so much. The gap between

Here’s something we have only seen once in 20 years In a true study of contrasts, the tech-heavy Nasdaq 100 index has soared 6.3% during

Stocks stand to benefit if the Fed eases up on the brakes Continued concerns about the health of the U.S. banking system and economy have

Bank woes raise questions about the Fed’s next move. Investors’ sudden hunger for U.S. government bonds has pushed yields to their lowest levels in months—and created

Chip stocks have come out swinging to start 2023 In what could be a harbinger of things to come for the markets, semiconductor stocks are

The U.S. real estate market has been flexing its muscles in recent weeks. Unexpected strength in the real estate market this week is the latest

U.S. stocks have clearly perked up so far this year. But now, two key market metrics show a heightened level of risk in domestic equities

In the wake of a bruising 2022, investors seem to have decided that “risk on” is where it’s at this year. Case in point: High-beta

Expected interest rate volatility has fallen 28 points so far this year The financial markets are predicting less volatility in interest rates during the coming

Investors eye foreign markets and like what they see. For more than a decade, international stocks have lost performance race after performance race to the

Put “protection” has come up short lately—but there’s a better way. Put options are often a go-to risk management strategy among investors seeking protection against

Up is down, and down is up Two key components of the equity market—growth stocks and value stocks—are looking significantly different as 2023 gets underway,

This year we have seen a first for stocks and bonds. Welcome to uncharted territory. As we head to the finish line, stocks are down

Everybody can appreciate a smooth ride—and for investors, a journey without too many bumps along the way can potentially result in more wealth. One

Throughout 2022, investors have seen various positive economic developments as signs that the Federal Reserve Board was ready to pivot and end—or considerably scale back—its

Could bond investors find the next few months to be “the most wonderful time of the year?” High-yield (or “junk”) bonds—along with the rest of

Investors won’t have to dip into their savings to pay for their Thanksgiving feasts this year, but they may choke on their pumpkin pie when they

Investors are shifting gears in the wake of good inflation news. Will it last? The tide is turning—maybe. Following last week’s news of lower-than-expected inflation,

The losers of the past are riding high—while yesterday’s winners appear to be out of gas. To sail to your destination, you need to put

We’re more than halfway through the third-quarter earnings season, and thus far, the S&P 500 overall is reporting its worst year-over-year earnings growth since the third

The squeeze on homebuyers appears to be getting tighter by the month—which could spell trouble for multiple sectors of the economy in the future. Today,

We all know that last week’s inflation report showed headline inflation continues to surge, with the consumer price index (CPI) accelerating by 8.2% in September

It’s a game of “catch me if you can” between investors and the Fed these days. For the most part, the Fed’s recent series of

Tomorrow, the Federal Reserve Board is set to announce its latest decision regarding interest rates. Will it be yet another 75-basis point increase, as many

All eyes were once again on interest rates last week, as the European Central Bank (ECB)—the eurozone’s equivalent of the Federal Reserve Board–raised interest rates

Demand for new homes is way down. What does that mean for investors? New home sales plunged in July, falling nearly 13% to a seasonally-adjusted

It’s a safe assumption that when Bob Dylan sang “the first one now will later be last,” he didn’t have financial markets in mind. And

What a difference a couple of months can make. Since hitting its low point (closing price) for the year on June 16, the S&P 500

Is More Volatility Coming Down the Pike? Investors looking for greater clarity about the road ahead for equities—and a break from market volatility—probably shouldn’t hold

As investors digested both the Fed’s decision to raise interest rates by another 75 basis points and the news that U.S. economic growth declined in

The U.S dollar continues its steady march higher, up 14.7% during the past 12 months. That sharp rise, coupled with the euro’s ongoing slide, created

Over the next few weeks, a steady stream of second-quarter earnings reports will reveal how companies have navigated historically high inflation, continued supply chain challenges,

The S&P 500 hasn’t seen two consecutive quarters of negative returns since the global financial crisis—until now, that is. The index’s -16.1% return during the

Economists surveyed by the Wall St. Journal now say there’s a 44% chance of a recession—up from just 18% in January. The newspaper noted that

Red-hot inflation, and the Fed’s now-aggressive efforts to fight it, are pushing up mortgage rates at their fastest pace on record—and potentially putting the squeeze

American workers are reliving the past – and that’s a potentially big problem. The reason: Real wages adjusted for inflation have recently declined, in some

Equity markets sent investors smiling into the Memorial Day weekend, thanks to the biggest weekly gains for the S&P 500 (+6.6%) and the Dow Jones

With the Nasdaq plummeting 27.2% and the S&P 500 Growth Index close behind at -26.2%, growth stock investors have taken it on the chin this

Investors in balanced portfolios these days may feel like they’ve fallen off a tightrope. The classic portfolio of 60 percent equities and 40 percent fixed-income—the

Investors liked what they heard from the Fed this week. The Federal Reserve Board raised the Federal Funds Rate by 50 basis points (0.50 percentage

No doubt about it: Fixed-income investors are spooked. Volatility in U.S. Treasuries has soared this year. As seen in the chart, the 10-day moving average

As Americans become more comfortable with Covid-19’s transition from pandemic to endemic, two of our key expectations for this year are that consumer spending will

Now that the Federal Reserve Board has started raising rates, the upcoming first quarter earnings season could arguably be one of the most interesting and

Investors sure are a gloomy bunch these days. How downbeat are they? According to the AAII Investor Sentiment Survey1 (a weekly poll measuring individual investors’

As expected, the Federal Reserve Board on Wednesday raised the target range of the federal funds rate—a key short-term interest rate—by 25 basis points from

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have an annual inflation rate of at least 5% in October.

Eye-popping jumps in energy prices worldwide has some people proclaiming we’re in a replay of the stagflation of the 1970s. That view ignores substantial

From the youngest to the oldest American workers – GenZ to Baby Boomers – their greatest fear about retirement is…

A large swath of the GenX population, many of whom are 20 years or less from the end of their working careers, say they don’t

The march higher in the cost of home health, assisted living or nursing home services continues. The blended cost of providing a year’s worth…

American workers just got another jolt of bad news about the financial health of Social Security. A recent report moved up the program’s insolvency date…

Federal Reserve Chairman Jay Powell repeated his view at last week’s Jackson Hole meeting that the jump in inflation would be “transitory” as supply…

There’s a record-breaking chasm opening up between American and Chinese stocks this year. The SPDR S&P 500 ETF (SPY) is outperforming…

The Baby Boomer retirement wave, egged on by Covid, rolls on. Another 248,000 Americans over the age of 65 left the labor force last month…

The Baby Boomer retirement wave, egged on by Covid, rolls on. Another 248,000 Americans over the age of 65 left the labor force last month…

You’ve likely heard that second quarter profits are surging, driven by easy year-over-year comparisons and the reopening of the economy…

Target date funds operate under the assumption that someone’s asset allocation should follow a glide path, automatically shifting a portfolio…

Yet another setback for retirees who view traditional fixed-income investments as a secure way to fund a long retirement…

The Federal Reserve’s meeting last week sparked a selloff in stocks and bonds as the central bank’s projections showed it may bump up interest rates..

Capturing the pandemic’s weird real-world effects is reflected in how high above trend retail sales are, at 12.9%, versus how far…

Bidding wars for homes has soured people on reaching for the American dream: for the first time in nearly 40 years, a majority of…

What was a rumbling of change in the last few years is now barreling into the mainstream with widespread name recognition of Bitcoin and…

What was a rumbling of change in the last few years is now barreling into the mainstream with widespread name recognition of Bitcoin and…

Millions of workers are retiring early. But not necessarily because they want to. The pandemic is pushing them to bow out of a job, according

When financial markets went haywire in March 2020, people pursuing a traditional financial plan may have been tempted to do something…

Of all the financial challenges facing retirees, being a widow can be one of the most difficult to bear. As the U.S. comes to the

Nearly every day the financial news headlines trumpet the selloff in bonds and the rising yields that go along with it. Some market pundits…

Like the famous Energizer Bunny, small-capitalization stocks keep on going versus their larger peers. Year to date, the S&P Small-Cap 600 Index is…

Does 2021 strike you as a replay of 1999? The investment theme now, as it was then, is to buy the companies on the leading

Up, up and away for the price of a new single-family home, which reached a record high $408,800 to kick off 2021. Goals-based clients who

Inflation isn’t a problem now, but financial markets are saying it could be soon. Traders are pricing in the possibility that Consumer Price Inflation…

A common investor assumption is that bonds tend to go up in value when the stock market is sliding. That’s been true during the bond

When stocks fall, bonds rally. That’s standard market action today. And it makes bonds look like a reliable way to counteract the stock market’s inevitable…