Consider a goals-based investment perspective going into summer

The old adage “April showers bring May flowers” proved true on Wall Street this year.

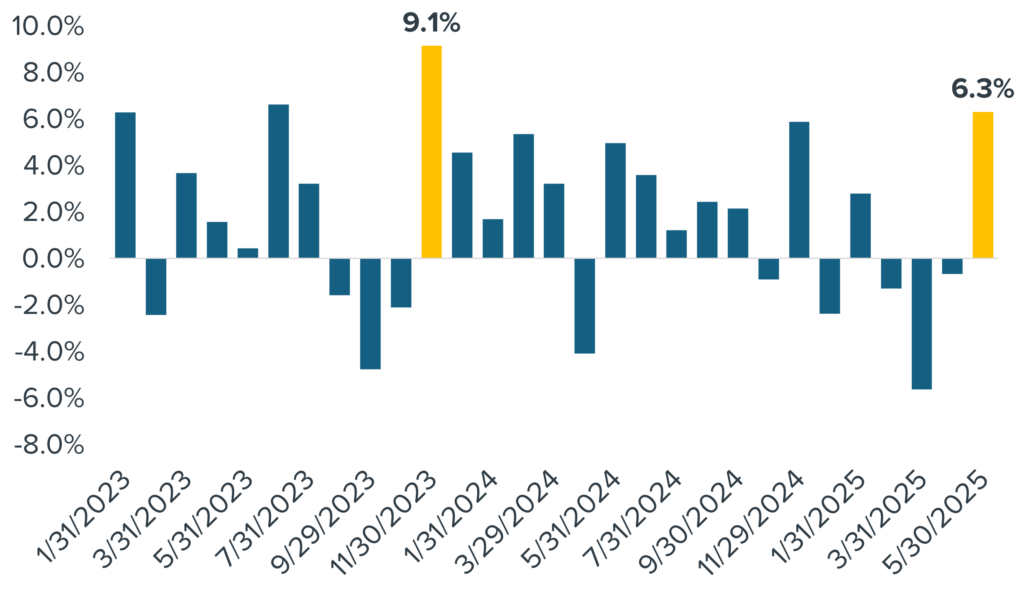

After falling 0.7% in April, the S&P 500 gained 6.3% last month, marking the index’s best May return since 1990 and its best monthly return since November 2023 (see the chart). Investors were heartened by a court ruling that could force President Trump to reduce or rescind his tariffs on other nations, as well as quarterly earnings results showing that the outlook for corporate profit growth remains healthy.

Another old adage, the one urging investors to “sell in May and go away” until November, would not have worked out well so far in 2025.

S&P 500 Monthly TR Returns (Jan. 2023 – May 2025)

Source: Bloomberg, calculations by Horizon Investments, data as of 06/02/25. Indices are unmanaged and do not have fees or expense charges, and dividend reinvestment makes no assumption about taxes, both of which would lower returns. It is not possible to invest directly in an unmanaged index.

Where do we go from here? Keep in mind that stock market returns during the “go away” summer months have been quite strong in recent years, with the S&P 500 averaging close to 7% over the three months from June through August since 2020. That said, it’s possible that some assets may have rallied too far, too fast lately. Also, the upcoming deadline for a tariff deal between the U.S. and Eurozone could weigh on stocks this summer.

Our thought: Skip the rules of thumb aimed at timing the markets, especially if they rhyme. Instead, consider helping clients establish personalized goals-based strategies designed to capture potential opportunities while effectively managing risks, and encourage them to stay focused on the longer-term objectives of their plan.